Most people don’t know. Take our quiz to find out.

May the Fourth be With You – PROMOTION 2017

To Those Who Might Want our RetirementView Software,

…SCROLL TO END OF ARTICLE FOR A SPECIAL OFFER….

May the 4th has become known as “Star Wars Day”! Built on the idea of May the 4th be with you.

I wanted to use this day to tell you about my recent trip on a Disney Star Wars cruise.

I got to take my wife and 2 youngest sons (still in high school) on the cruise which offers Star Wars movies, characters, memorabilia, and of course the awesome “Star Wars Day at Sea”.

Being like a big kid, I signed up for a couple of “character encounters”.

My encounter with Darth Vader was quite scary.

The dude is like 6 foot 8 in the Darth costume and he has the “real” James Earl Jones voice – I assume from a voice converter box. He said that I looked like I might be part of the “rebel alliance”.

I was lucky to even get a picture before he pulled out his light saber and tried to chase me down!

On another encounter, I got to meet R2D2 and C3PO.

These droids were alive and active.

C3PO shook my hand when I walked up and talked to me ad lib in the C3PO voice.

Meanwhile, R2D2 was blinking and chirping with his computerized “voice” during the entire photo encounter.

It was so real I couldn’t believe it.

I had to get a photo to “prove” I met two of the most outstanding movie characters of all time.

Although R2D2 is soooo cool, the wit and wisdom of C3PO has always made him my favorite.

My wife and kids were too tired to want to get up to meet R2D2 at 8am. Sure I was on vacation but I would have gotten up at 5am to see these guys!

During the cruise we could watch any Star Wars movie we wanted on demand except Force Awakens which was only in the theater.

They have a full size theater on the ship just for showing movies!

On the ship’s opening departure party, they have a lot of Star Wars and Disney characters there to “see us off”.

This deck party has a lot of music and dancing and typical Disney show flare.

On the Day at Sea you can buy the BB8 cup (you can see it in the Darth Vader picture) or a Bobo Fett cup.

They double down on the movies and show Star Wars the CLone Wars cartoon on the huge deck screen.

At night they have another deck party where there is a mob of people dancing and celebrating in Star Wars costumes.

There are so many light sabers out on the deck and costumes that it makes for a really cool experience.

This article is mainly about “STAR WARS” but the cruise itself is fantastic. I’ve added a couple of pictures at the bottom if you want to see them.

SPECIAL OFFER: MAY THE FOURTH BE WITH YOU!

IF you are smart enough to follow these directions, you will be rewarded with a 20%, 30% or even 40% discount on our RetirementView software.

And this promotion is good for ANY edition.

Directions:

– find pictures of actual Star Wars characters in this article

– write down their names in all CAPS

– if their name is greater than 4 letters, then mark out everything after the first 4 letters

– go to the page for the edition you want to purchase. Personal or Couples or Professional Edition.

– enter into the Promo Code the 4 character “name” of one of the Star Wars characters you have selected (hint: not traditional Disney characters but Star Wars only)

– a DISCOUNT should appear on the order form

– Complete the purchase process and enjoy using the RetirementView software!

May the Fourth Be With You in Your Retirement Planning!

THESE SPECIAL DISCOUNTS END FRIDAY MAY 5th at MIDNIGHT!

May the Fourth Be With You in 2017! – Clients

To our Valued Clients,

May the 4th has become known as “Star Wars Day”! Built on the idea of May the 4th be with you.

I wanted to use this day to tell you about my recent trip on a Disney Star Wars cruise.

I got to take my wife and 2 youngest sons (still in high school) on the cruise which offers Star Wars movies, characters, memorabilia, and of course the awesome “Star Wars Day at Sea”.

Being like a big kid, I signed up for a couple of “character encounters”.

My encounter with Darth Vader was quite scary.

The dude is like 6 foot 5 in the Darth costume and he has the “real” Jame Earl Jones voice – I assume from a voice converter box. He said that I looked like I might be part of the “rebel alliance”.

I was lucky to even get a picture before he pulled out his light saber and tried to chase me down.

On another encounter, I got to meet R2D2 and C3PO. These droids were alive and active.

C3PO shook my hand when I walked up and talked to me ad lib in the C3PO voice.

Meanwhile, R2D2 was blinking and chirping with his computerized “voice” during the entire photo encounter.

It was so real I couldn’t believe it.

I had to get a photo to “prove” I met two of the most outstanding movie characters of all time.

Although R2D2 is soooo cool, the wit and wisdom of C3PO has always made him my favorite.

My wife and kids were too tired to want to get up to meet R2D2 at 8am. Sure I was on vacation but I would have gotten up at 5am to see these guys!

During the cruise we could watch any Star Wars movie we wanted on demand except Force Awakens which was only in the theater.

They have a full size theater on the ship just for showing movies!

On the ship’s opening departure party, they have a lot of Star Wars and Disney characters there to “see us off”.

This deck party has a lot of music and dancing and typical Disney show flare.

On the Day at Sea you can buy the BB8 cup (you can see it in the Darth Vader picture) or a Bobo Fett cup.

They double down on the movies and show Star Wars the CLone Wars cartoon on the huge deck screen.

At night they have another deck party where there is a mob of people dancing and celebrating in Star Wars costumes.

There are so many light sabers out on the deck and costumes that it makes for a really cool experience.

This article is mainly about “STAR WARS” but the cruise itself is fantastic. I’ve added a couple of pictures at the bottom if you want to see them.

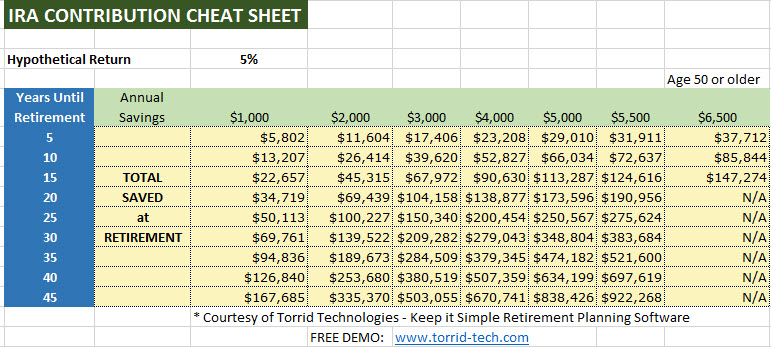

2017 IRA Contribution Savings Cheat Sheet

You may be bombarded with messages to “make your IRA contribution” this time of year.

For 2017, you have until April 18th tax day to finalize that contribution for the 2016 calendar year.

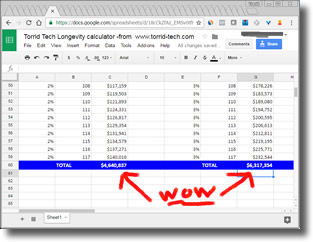

I was curious as to whether we could calculate various contribution amounts over many different time periods to see how long it would take to accumulate $1 million in an IRA.

So I fired up an Excel spreadsheet mainly because I wanted to create a matrix that shows many results in a small window.

Normally I would have fired up my RetirementView software and just run some numbers in there. But if I did that I would have to run each scenario and then log the results.

Here is the “cheat sheet” that I created in Excel for 2017.

To explain what this means, I first explain that the entire calculation is based on a flat 5% return. If you had my spreadsheet, you could change this return and have the matrix recalculate all the values at a different return.

The left column in blue shows the number of years until retirement – this is the number of years that you “save” the amount specified in “Annual Savings”.

The green “Annual Savings” columns are showing you the calculations if you save $1,000 each year or $2,000 each year…. for the time period in blue.

The yellow area shows you the total amount accumulated for the time period including the compound interest of 5%.

Did I get to $1 million?

No. The only place we got close was if we saved $5,500 a year for 45 years.

My guess is if we increased the interest rate to 6% we would be over the top.

So I did that in my Excel spreadsheet and voila the $5,500 for 45 years gets us to $1,240,295!

If you’d like to get a copy of my little IRA Contribution cheat sheet spreadsheet in EXCEL format, then CLICK HERE to get your copy of the Cheat Sheet for FREE.

Thanks and Happy Planning!

What if YOU lived to be 117?

Well it’s official the oldest living person on planet Earth is Emma Morano.

She lives in ITALY of all places. What is her secret to long life?

She says eating 2 raw eggs every day!

Now what will happen if you live to be 117?

Can you even afford it?

Our programming gnomes put together a little spreadsheet for you to figure it out.

Click here to see if you can afford it

On this spreadsheet it will show you how much money you need to live from age 65 all the way to age 117 at two inflation rates – one at 2% and the other at 3%.

Here is what we did. We assume that you retire at age 65 and then live to be 117 years old.

We assumed that you need just $50,000 of income starting at age 65. Yeah we realize that you may require much different income.

We then used a 2% inflation rate in one set of calculations and a 3% inflation rate in the other set of calculations.

The spreadsheet then TOTALS up all of the income from age 65 to 117 to give us a running total of dollars you would need over that time period.

So can you make it for 52 years in retirement? Click here to find out.

[If you want to read the full CNN article, you can access it here.]

Make Retirement Simple Book Hits #1 on Amazon.com Kindle

My first book has been published on Amazon Kindle and hit #1 on several of the charts! It’s very exciting. The print version will be coming out in the next couple of weeks.

I’d just like to thank my co-authors Travis Evans, Craig Cassidy, and Jeff Biro. Congratulations to you guys too for being a “Best Selling Author”!

If you want to check out the KINDLE version here it is on Amazon.com: http://amzn.to/2cffv2J

WOULD YOU LIKE THIS BOOK FOR FREE? Get our LABOR DAY SPECIAL and we will mail you a PRINTED COPY once it is ready later this month. You will get ALL of the following if you get going this Labor Day weekend:

1). Full RetirementView software

2). The Latest 2016 Edition (and 2017 edition when it is ready in January)

3). you get 1 year of updates from date of purchase

4). you get our QuickStart Guide

5). you get unlimited support by e-mail and phone.

6). you get our iron-clad 100% 90-Day Unconditional Money Back Guarantee (new customers only).

7). you get our online training videos that teach you how to use the software.

8). BONUS: LIVE Q&A Call with Tim Turner – bring all your questions

9). BONUS: $25 TARGET GIFT CARD

10). BONUS: FREE 2016 CD IN THE MAIL

11). * BONUS *: Copy of Print Verion of Tim’s Best Selling Book “Make Retirement Simple” (once it is ready in print)

If you’d like to get this, click here to order!

From a Real Client: A LETTER FROM Julliette?

I got an email the other day. If you have any interest in the RetirementView software I thought you might want to read it.

Here it is….

Hi Tim,

I was just telling another person today about your software, strongly encouraging it (again).

During lunch, he was telling me that he’s thinking that the consulting assignment we’re on now may be his last. I asked how he was sure he can afford to stop working yet. He said he knows his budget and his savings and what he can expect from investment returns and SS. I don’t doubt that, but to me it seems so much more complicated than that. Has he factored in inflation? How can one estimate what one will lose to tax payments when one begins to liquidate assets from IRAs vs ROTH IRAs vs taxable investment accounts? That makes too huge a difference to not factor that? I can’t imagine even THINKING about deciding when one can end one’s career without either using a sophisticated software package like yours or hiring a financial planner to do an analysis (who might end up using your software to do it, or a package that’s similar!). When a question is as critically important to answer correctly as this one–whether one has enough savings to last the rest of one’s life and cover any likely contingencies– it seems that one would be foolish to not invest the money to double check their relatively rough estimates.

I’ve told so many of my friends about your software, and it amazes me that I don’t think anyone has acted on the recommendation (though one does plan to as soon as she has some time she can anticipate dedicating to it).

As for me, in response to losing my job 5 years ago, I made the decision to change my profession in order to be more marketable long-term. It took three years to research and decide what I want to do next, then study to learn the new career, and then network and jobhunt like crazy. The painful result was that I decreased my savings by $170K during those three unemployed years (it’s very expensive to live near Boston!, and some of that was paying taxes on some partial IRA to Roth conversions I decided to do while I was earning practically nothing and thus at a low tax rate).

That set my financial plan WAY back. The good news is that although it took a long time and was VERY challenging, I eventually managed to get a very good job in my new profession (Business Analysis consulting). In the almost 2 years since then I’ve saved as much as I possibly could to start getting back on track for what I hoped would be an early retirement from my technical profession. My ardent desire is to be able to focus on my passions for art and loving (primarily) and sailing and being outdoors and exploring. It feels so discouraging that between having withdrawn so much of my savings to live while unemployed and my portfolio having lost so much value in the recession (and not fully recovered), there’s been such a major setback. And the outlook for ROI seems so very low that after inflation takes its toll, it’s not appearing that I can realistically hope for my savings to double in 7 years as rates of return used to enable. But oh well. One must adapt and deal with the what is.

I really love knowing that I’ll be able to reassess where I stand with regards to a reasonable retirement year estimate with the aid of your software in which I have a good deal of confidence (even though I don’t have much confidence in the crap shoot of my choice of variables to enter into your software!, since those variables could go any which way, as we’ve seen).

Thanks again for a super product!,

Julliette

—- we’ve left her full name off so not to violate her privacy. But thought you’d see some real insights into HOW and WHY people use our software.

Thanks and Happy Planning!

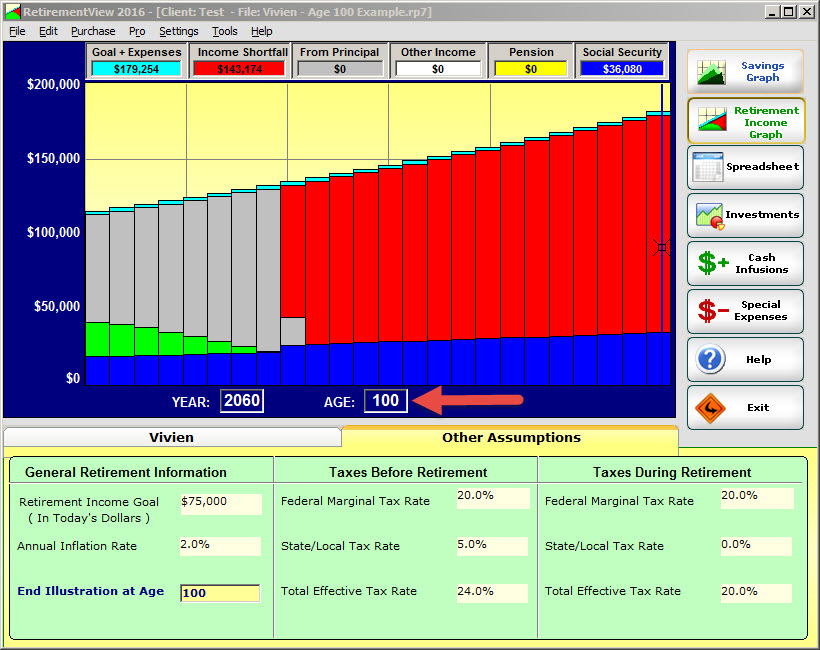

Can You Afford to Live to 100?

This week on May 19th, 2016 my wife’s grandmother Vivian celebrated her 100th birthday in Huntsville, Alabama.

Last weekend we celebrated her birthday at a party at her retirement home.

Vivian was in great spirits and happy to see everyone celebrating with her.

Of course we had a huge birthday cake for her.

It got me thinking about “what does it take financially to live to 100”?

Have you thought about that at all? What if you make it to 100 and beyond?

Of course, using the RetirementView software you can run some scenarios out to 100 and see how your finances play out.

If you want to use the Consumer version of the software to plan for yourself or for you and your spouse, then go here to get going.

Vivian doesn’t hear all that great so I didn’t get to quiz her on the “Secret” to living such a long life. But I do know she has been a big vegetable and fruit eater all her life. She also was meticulous about getting to all her doctor’s appointments.

If you wonder whether you can financially handle living to age 100, then again you can go here to get going on the software. Build your own picture. See how your investments and income items will work together. You will know pretty quickly in red if you aren’t going to make it. And more importantly, you will be able to make adjustments and see what types of changes will help you make it for the long haul.

May you be blessed to live to 100 just like Vivian. Thanks and Happy Planning.

Regards,

-Tim Turner

New Mac Version of RetirementView – 2016.3

Torrid Technologies, Inc., a company based out of Marietta, Georgia, has recently released the 2016.3 version of their award-winning Retirement View software for Mac computers. The new version includes several important enhancements and improvements. The software has been in circulation and consistently updated since 1994 when it first appeared for the Mac operating system.

The software was designed to help individuals plan their retirement, even if they aren’t that good with a computer and know little about financial planning. It is also used by financial advisors to create visual retirement plans for their clients. Torrid Technologies founder Tim Turner says, “Our Retirmenet View software is for anyone concerned about whether they are saving enough for retirement. It’s more robust than free internet calculators and way easier to use than most complicated software systems.”

Currently, Torrid Tech is offering a free demo of the software from the company’s website at http://www.torrid-tech.com. The tool is described as being easy to use, easy to learn, and uses a simple fill-in-the-blank system. It works instantly and accurately to create your retirement saving plans in less than 15 minutes.

The Retirement View software for Mac can be downloaded directly from the Torrid Technologies site for both individuals and financial advisors. From there, potential users of the software can read the reviews of current customers, speak to a member of the team or learn more from their knowledge base.

A unique video tour of the capabilities of the 2016 retirement view software release is also available through the website, providing some insight into the upgrades and additional content which users can benefit from during the retirement planning process. This walks users through entering data such as Social Security, Pensions, investments, benefits, special expenses, and other cash disbursements. It also shows why using a basic online calculator for this type of planning is inefficient and dangerous.

Price varies between the personal edition, couple’s edition, and professional edition, but all versions offer the same colorful graphics, real-time experience, and uncomplicated process to provide users with effortless planning potential. The company invites interested parties to download the trial version and see for themselves how easy it is to build your own retirement plan and take control over your retirement finances.

RetirementView software is available on both Mac and Windows computers, as well as tablets. Consumers use it for do-it-yourself retirement planning for both employees and those already retired. Financial advisors use RetirementView to build retirement plans for clients that they can see and discuss changes to avoid running out of money.

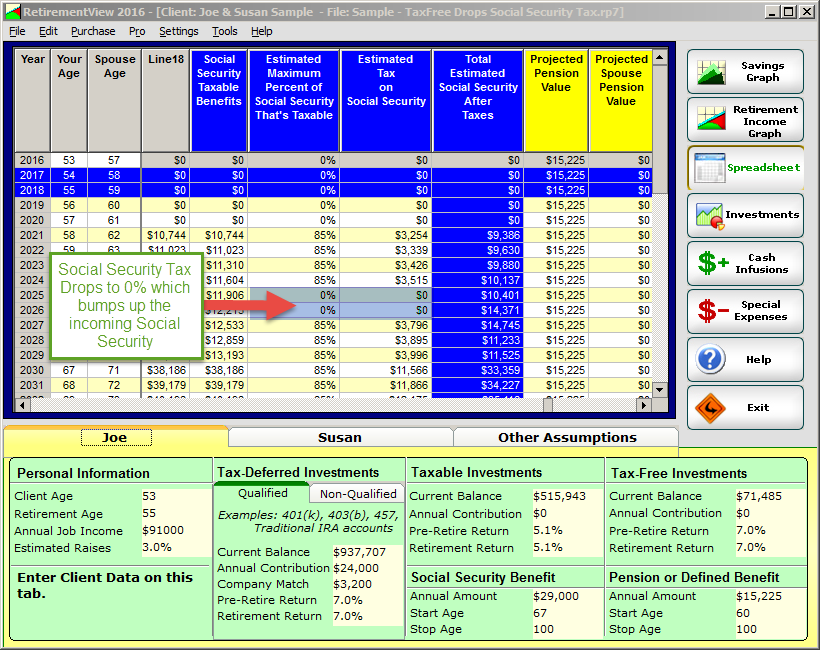

Mystery: The Case of the Jumping Social Security Income

Hello,

Glad you are here and I wanted to try to make this article a little LESS BORING by telling the story of a MYSTERY that needs to be solved.

Do you have a bit of Sherlock Holmes in you? Can you crack this case?

The taxation of Social Security is a bit of a complicated topic, but the basics are that the IRS has a specific worksheet that you can fill out to figure out the “tax” you will owe on your Social Security. Part of your Social Security is tax free, but then it can jump up to 50% or 85% taxable depending on other income and various factors.

If you want to learn how to calculate it, then consider getting the “Social Security Taxation Kit” that we offer which explains it all through video and worksheets.

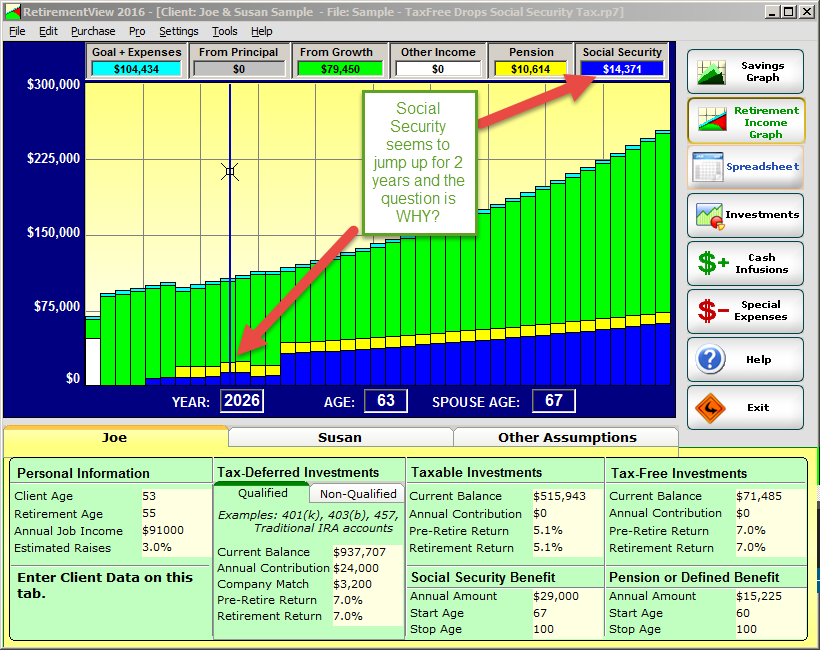

Meanwhile, I wanted to share a SPECIFIC case study that an advisor sent in that shows an interesting “visual” anomaly in the RetirementView program. NOTE: this not a the real file but a copy and all identifying information has been removed.

So let’s dig in… first look at the main Retirement Income Graph below. The advisor sent this file in asking “Why does the Social Security jump up by over $4,000 for 2 years and then drop back down? ” You can see where we point out this anomaly in the following graphic:

If you are an advanced RetirementView user, think to yourself “Why would this happen?”

If you are an advanced RetirementView user, think to yourself “Why would this happen?”

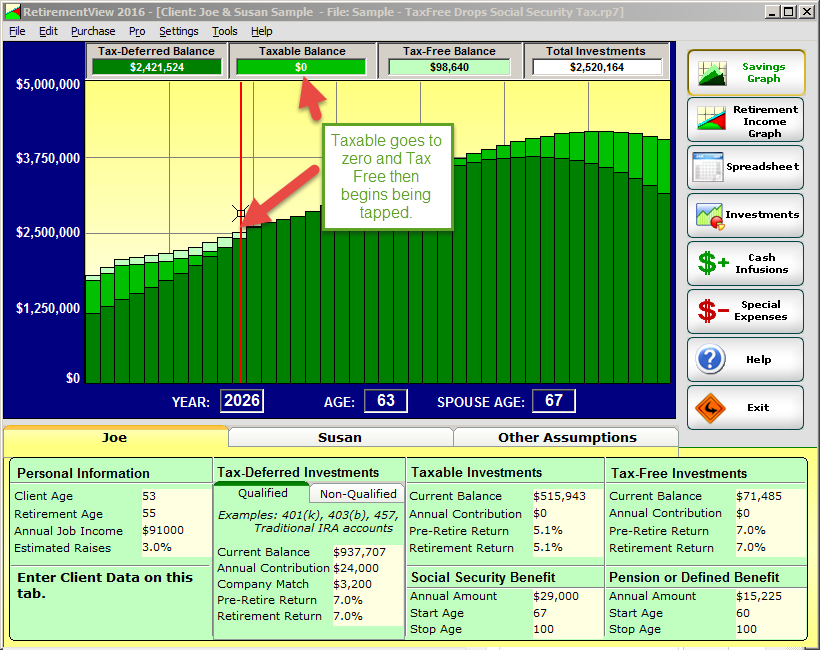

To search for clues about this, I flipped to the Spreadsheet to examine the numbers. If you scroll to the right you will eventually get to the royal blue Social Security columns. Indeed, we see that there are 2 years where the taxation drops from 85% to 0%. This causes the amount of income from Social Security to INCREASE. Notice that’s counterintuitive to think about… taxation DROPS but income INCREASES. I guess that’s why everyone would like lower taxes (except maybe our government).

Here is a graphic showing the spreadsheet columns that are relevant. Now this is an internal copy where we have columns for every one of the Social Security taxation lines on the IRS worksheet so we can validate our calculations.

The question is WHY is this happening. Well first you have to understand the Social Security taxation algorithm which is too much to explain here. But the revelant key is that Tax Free investment withdrawals from a Roth IRA account, do not get added into the calculation of taxes on Social Security. So when you withdraw money from your Roth IRA in retirement, it won’t affect your Social Security taxes at all.

Whereas, when you withdraw from Taxable accounts or Tax-Deferred Accounts like Traditional IRAs and 401(K) plans, then that income IS included in the taxation algorithm for Social Security.

The second clue you need to figure this out is to look at the Savings Graph. When we looked there we see that Taxable investments get depleted right before the anomaly. At that point the program begins to tap the Tax Free investment bucket to satisfy the target retirement income needs. When that happens, the taxation on Social Security drops to 0% and thus the income from Social Security increases by over $4,000!

Here is a screenshot of the Savings Graph pointing out the depletion of Taxable:

Now go back up and see the original Retirement Income Graph picture… you can see the Social Security jump up for two years.

In Retirement View the order of investment depletion is Taxable, Tax Free, Non-Qualified, then last is Qualified. So program taps the Taxable until it is gone and then switches to Tax Free. When it does so, the withdrawals reduce the taxes on Social Security which then increases the net Social Security income after taxes.

And now mystery solved! You know why this is happening.

Another retirement planning case closed. Til next time and Happy Planning!

Regards,

-Tim

Recent Comments