Hello,

Glad you are here and I wanted to try to make this article a little LESS BORING by telling the story of a MYSTERY that needs to be solved.

Do you have a bit of Sherlock Holmes in you? Can you crack this case?

The taxation of Social Security is a bit of a complicated topic, but the basics are that the IRS has a specific worksheet that you can fill out to figure out the “tax” you will owe on your Social Security. Part of your Social Security is tax free, but then it can jump up to 50% or 85% taxable depending on other income and various factors.

If you want to learn how to calculate it, then consider getting the “Social Security Taxation Kit” that we offer which explains it all through video and worksheets.

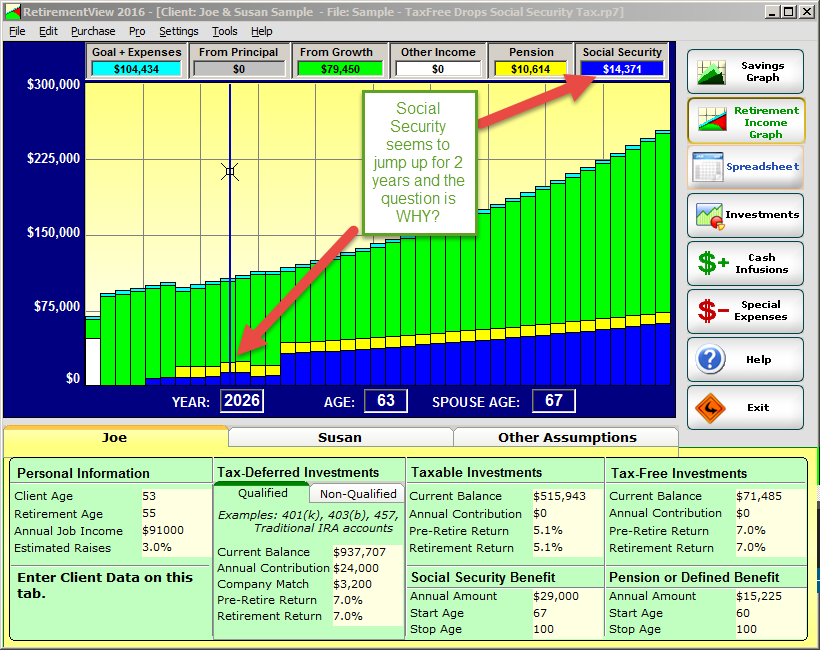

Meanwhile, I wanted to share a SPECIFIC case study that an advisor sent in that shows an interesting “visual” anomaly in the RetirementView program. NOTE: this not a the real file but a copy and all identifying information has been removed.

So let’s dig in… first look at the main Retirement Income Graph below. The advisor sent this file in asking “Why does the Social Security jump up by over $4,000 for 2 years and then drop back down? ” You can see where we point out this anomaly in the following graphic:

If you are an advanced RetirementView user, think to yourself “Why would this happen?”

If you are an advanced RetirementView user, think to yourself “Why would this happen?”

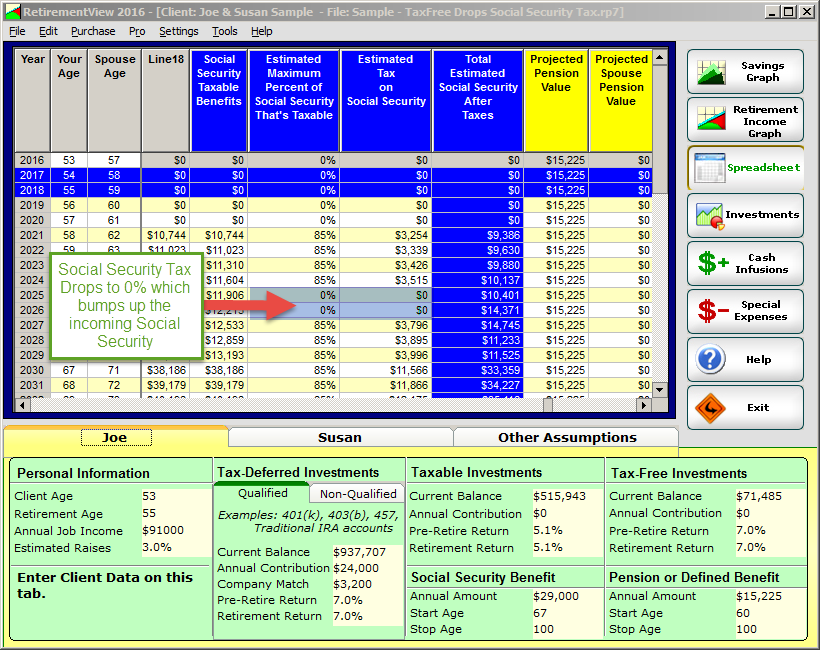

To search for clues about this, I flipped to the Spreadsheet to examine the numbers. If you scroll to the right you will eventually get to the royal blue Social Security columns. Indeed, we see that there are 2 years where the taxation drops from 85% to 0%. This causes the amount of income from Social Security to INCREASE. Notice that’s counterintuitive to think about… taxation DROPS but income INCREASES. I guess that’s why everyone would like lower taxes (except maybe our government).

Here is a graphic showing the spreadsheet columns that are relevant. Now this is an internal copy where we have columns for every one of the Social Security taxation lines on the IRS worksheet so we can validate our calculations.

The question is WHY is this happening. Well first you have to understand the Social Security taxation algorithm which is too much to explain here. But the revelant key is that Tax Free investment withdrawals from a Roth IRA account, do not get added into the calculation of taxes on Social Security. So when you withdraw money from your Roth IRA in retirement, it won’t affect your Social Security taxes at all.

Whereas, when you withdraw from Taxable accounts or Tax-Deferred Accounts like Traditional IRAs and 401(K) plans, then that income IS included in the taxation algorithm for Social Security.

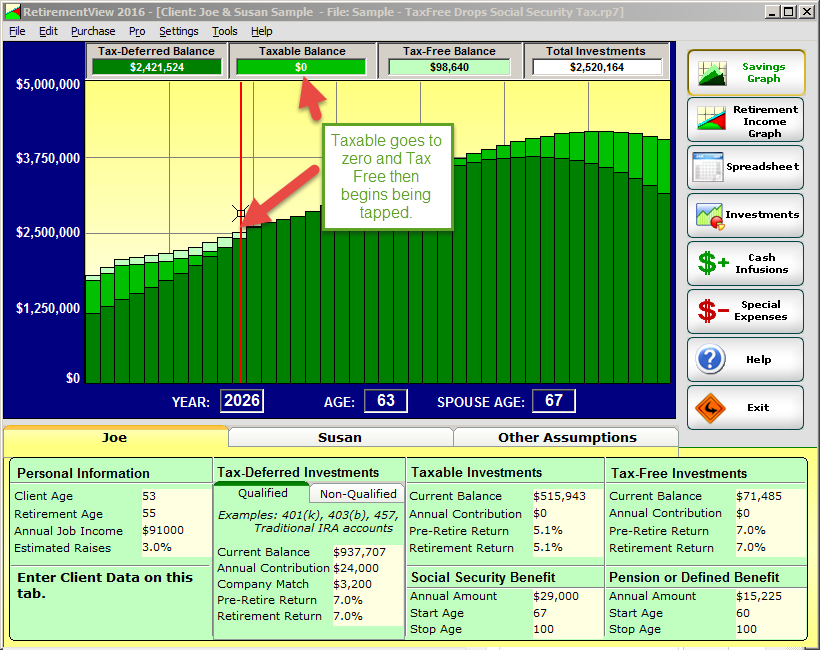

The second clue you need to figure this out is to look at the Savings Graph. When we looked there we see that Taxable investments get depleted right before the anomaly. At that point the program begins to tap the Tax Free investment bucket to satisfy the target retirement income needs. When that happens, the taxation on Social Security drops to 0% and thus the income from Social Security increases by over $4,000!

Here is a screenshot of the Savings Graph pointing out the depletion of Taxable:

Now go back up and see the original Retirement Income Graph picture… you can see the Social Security jump up for two years.

In Retirement View the order of investment depletion is Taxable, Tax Free, Non-Qualified, then last is Qualified. So program taps the Taxable until it is gone and then switches to Tax Free. When it does so, the withdrawals reduce the taxes on Social Security which then increases the net Social Security income after taxes.

And now mystery solved! You know why this is happening.

Another retirement planning case closed. Til next time and Happy Planning!

Regards,

-Tim

Speak Your Mind

You must be logged in to post a comment.