This video will show you an example of how Required Minimum Distributions from a Qualified account can increase the taxation of Social Security enough so that it is thousands of dollars a year.

New Bill for “SECURE Act 2.0” Could Change Retirement System

A new effort is gaining support by some lawmakers in Washington. The House Ways and Means committee is unveiling a new bill that hopes to secure retirement for many with a new bipartisan bill.

Some of its notable features include automatic enrollment in company retirement plans if one is offered. It’s also rumored to raise the mandatory age for distributions again. This age would move (again) from 72 to 75.

Secure Act 2 hopes to also provide tax breaks if certain people start saving for retirement and would likely explore the possibility of a national retirement plan.

Read more about it here.

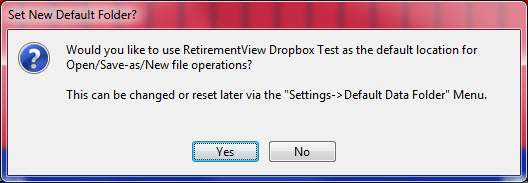

RetirementView Support for Cloud Storage and Shared Network Folders

Starting with release 2020.2 we have added new support to make it easier to use cloud storage systems like:

Google Drive

Dropbox

iCloud Drive

OneDrive

Box

IDrive

Basically when you create New files, you can move the files to use your cloud storage. When you do that, RetirementView will now ask you if you want to use that location as the “default” for creating, opening, and saving your data files.

If you say “Yes” then every time you create or open a file it will default to your cloud storage location.

The advantage is that it saves a LOT of clicks each time you are working with files.

This same update also helps if you are using a “Shared Folder” on a network in your office. You can go there once and it will ask if you want that as your default. If you say “Yes” then you won’t have to do all those clicks again!

Hope you enjoy this new enhancement…

Thanks and Happy Planning!

Your Client Data is at Risk

Sorry to alarm you but I have been saying for years that it’s just a matter of time before hackers realize there is a lot of money in retirement and investment accounts.

And then they will start trying to hack systems like Redtail, eMoney, MoneyGuide Pro, and all the other internet accessible CRM and financial planning systems.

In this InvestmentNews article it explains about how Redtail was indeed hacked.

And this article right here explains how many other systems are ripe for hacking.

What is your legal liability when client data is stolen from these online systems?

Do you really think you are immune from a lawsuit in this area?

As an attorney myself I would argue that you are a ripe target for lawsuits for such breaches of privacy. After all you decided to put your client’s data “online” by using these various systems.

Want to keep your client data secure?

Want to sleep easy at night knowing hackers aren’t targeting your client data?

The ultimate option is to stick to desktop systems like RetirementView Pro…

Not only is it easier to use than other systems, but it’s easier for client’s to understand.

And now… it’s also MORE SECURE than other systems.

Just one more advantage of using the best retirement planning software on Planet Earth.

Alan C., Advisor – “I doubled my closing ratio” by switching to RetirementView Pro

FULL TRANSCRIPT

Tim: Hey, this is Tim Turner, Torrid Technologies. We like to interview clients that use

our software so that you can find out more about how it’s used by actual

advisors. Today, we have Alan Cantrell from Fayetteville, Arkansas. Alan, you

there?

Alan: I’m here, Tim. It’s great to be here.

Tim: Well, I’m really glad to have you on here. Why don’t you just go ahead and tell us a

little bit about yourself and your practice, just at a high level, so we can

get to know you.

Alan: All right, well, I have … Okay. I have Retirement Strategies Group here in Northwest Arkansas. Been in the financial services business for right at 35

years now. I am an Investment Advisor representative as well, so we gather assets under management as well as other parts of the financial services.

Tim: Okay, great. For everyone listening to this, Alan just got this program, our RetirementView program. He got it only about two and a half months ago. What I

want to ask you about, Alan, before we dive into how things are going for you now, let’s go back to before you got RetirementView.

What kind of things did you struggle with? What were some of the problems with meeting with prospects, people you’re trying to show your value to, to bring them on as clients? What were your challenges?

Alan: I think a lot of my challenges, Tim, were I’ve had software in the past that

sometimes I think the client had struggled to understand it. I knew what the

software was trying to get across, but a lot of times, I think there were some

difficulties with them understanding the software. Whereas with RetirementView,

I have never in my career had clients scoot up in their seat and look at …

I’ve got a large, big screen monitor on my wall and it’s like they just move

toward it when they’re looking at RetirementView.

We start from the building it out in the beginning where everything’s red as far

as your income. As we add their assets to it, the red starts disappearing. I

just love the way, as we’re adding the assets, how they just continue to move

up in that seat and get closer to that monitor.

My desk is set away from the monitor and they’re sitting at my desk looking at me.

I also have a conference table there where the screen is on the wall. I’ve

actually had clients get up out of their chair and move over to the conference

table to even get a closer look. It’s just amazing. I love it.

Tim: You’re going from eyes glazed over, “I want to get out of this meeting,” to

like, “Hey, I’m not only leaning forward, I’m getting out of my chair to

get closer to this thing.”

Alan: Exactly, that’s right. As I get more proficient with the software, it’s just, it’s even

getting better because of the way I’m building it and taking the red out with

them. Once I’ve seen …

I actually learned that from watching an interview with someone on your software,

where I got on YouTube and saw how the two of you were building it out on that.

I thought, “This is the way to do it,” and it just, it helps. It’s

just, it’s really exciting watching them.

Tim: Wow, that’s great. The challenges, so before, you were so excited, you jumped into

the, “Hey, I now have the software,” and what the challenges were.

Previously, before you got the software, you found it a challenge to convey to

people the problem that they needed to solve, right?

Alan: That’s right. It …

Tim: Talk more about the challenge. Talk about like what was not working. Because that’s

real important to anyone listening to this, because they probably have a

similar challenge.

Alan: I think the challenge was with a lot of software that I’ve had in the past, it

was getting through the software, taking them to different parts of the

software and showing them where their money is, how long it’s going to last,

and we’d have to go through so many pages.

Whereas with the graph that you’re showing right now on the screen, it’s so simple when

you take them to their current age and move along. When we do have the red, after we’ve put in all their assets, then we’re going to talk about at that point, maybe some changes we could make. Getting them some guaranteed lifetime income.

If there’s not anything there to help that money, even when they do run out, to have more guaranteed income rather than just with social security. We do build other income in there with maybe some indexed annuities or something to that effect.

When we do that and can show them how we can answer that problem, that helps as well. Where in other software that we’ve had in the past, it just didn’t seem like that was there.

Tim: Okay. You struggled with showing them when they’re going to run out of money, showing them how their investments and social security is going to play into their retirement.

Alan: That’s right.

Tim: You didn’t really have an easy to way to show that.

Alan: That’s right.

Tim: What was the end result when you struggled with that? Like you’re meeting with

someone, it’s getting a little clumsy. They may not understand. What happens at

that point? Like how did the meeting go?

Alan: I think that affects your closing ratio. A lot of times, we would book another

appointment and try to clear it up a little bit maybe. Take away a little bit

of the smoke and clean it up. I think with RetirementView, I know it’s helping

my closing ratio already, and I think it’s just going to help it that much more.

The more proficient I get with it, I think it’s going to help it that much

more.

Tim: Okay. Well, I don’t, I don’t mean for this to be a demo, but you brought up

annuities, so just in 10 seconds, all I want to do, and I mainly wanted this to

be about you, but I mainly wanted to show an annuity. You’re doing indexed

annuities? Or what type of annuities you doing?

Alan: Yes, Indexed annuity.

Tim: Okay, so let’s just put … I just want to show them what it looks like, since you

mentioned it. Lifetime annuity, payments, and give me a sample income, just

anything.

Alan: 25,000.

Tim: Okay, so they’re going to get 25,000 for life.

Alan: Mm-hmm (affirmative).

Tim: I’m just going to put 62. That’s a little after this guys starts. Duration, we’ll

do 40. It’ll run to the end of his life. Will he owe taxes on that money? It

depends on whether it’s qualified or not really.

Alan: Right.

Tim: Let’s say he owes some taxes. Then I hit “add to plan.” Again, we’re not

doing really a full demo of the software, but you see the white there, that’s

what Alan was talking about, is the annuity income. You see the blue is the

social security, so that’s their social security for life. Then you’re adding

on more guaranteed income as a base to their picture, and that also gets rid of

some of the red. I just wanted to show that-

Alan: Correct, yes.

Tim: I just wanted to show that since it’s so simple to show. Okay, so let’s move into, you’ve already, you can’t even help yourself, Alan. I’m trying to get you to focus on before you

got the software, and you keep wanting to jump to having the software, which is

awesome because I can tell how excited you are.

Let’s talk about, you got the software about two and a half months ago. How long did

it take you to learn it and meet with your first client or prospect? Either

way.

Alan: It’s really amazing because I was probably able … Well, I had an appointment the

following week and got through the appointment really well, and those clients

understood it. They saw the red.

Matter of fact, I think it’s this particular client that you have up here right now,

were the first ones that I actually showed software to, and they’re becoming a

client … He’s actually, his retirement is actually this year, so they’re

becoming a client.

We’re going to move all their money. Some of it will be going into annuities and the

rest of it will be going into assets under management. That’s one of the things

we talk about with this, and it’s helped. RetirementView has really helped with

how we talk about, we like to put about, we like to do 50-50 a lot of times

with a lot of our clients, because we like to go into, what we’d like to do or

what we feel like our perfect model is, is about 50% of their money and assets

under management and 50% driving income.

RetirementView, a lot of times it amazes me when we do that. We’ll go in there and they’ll

actually have more assets to pass along to their heirs at the end than they would have if they had not started the income, so that, to me, that’s a beautiful picture to paint for them.

Tim: Great, yeah. It sounds like it only took you about a week to learn the software and

meet with your first client or prospect.

Alan: That’s right. I’ve had problems, I’ve had to call y’all a few times and say,

“What do I need to do here?” What’s so great and what I really love

about you, Tim, is I can email you and you usually answer me within 30 minutes

and tell me, suggest what might be wrong and 9 times, well, 10 times out of 10,

you’re correct as to what’s wrong.

Sometimes, you’re not there, and your girls that work there are very proficient in the

software as well, usually when I’ll speak with them.

Tim: Well, good. That sounds awesome. It didn’t take long to learn how to use the program.

I think that’s a big challenge for advisors thinking about switching to a

different tool or even just trying it like, “Oh my gosh, what’s it going

to take?” Just to elaborate on that, did you have to fly out to a two day

training class to learn how to use this?

Alan: No, no. It’s really incredible.

Tim: What did you do? What did you do to learn it? Like you bought it and you’re ready to

get going. What did you do?

Alan: Yeah, well, like the screen you’re on right now, initially, I was just punching in

their numbers right here. I would put it in the husband’s numbers like you’ve

got right here. Then we’d moved to the spouse. If she worked, we’d put in her

numbers. Sometimes we’d just have to put in her social security benefit.

Then we’d move to other assumptions and put in what kind of income they wanted

during retirement, and boom. There it is. It’s either going to last them or

they’re going to have a shortfall, and we start working from there.

Then, one of the initial problems I ran into, and if I can help anyone here, is if

you put in numbers here, you don’t want to go over to and start putting numbers

into their investments. Then it’s going to screw it up a little bit. You might

explain that a little bit further, but I, on a couple of them, I would put

everything in right here and then I’d go into investments and I would start

putting each asset as to what it was, and you don’t want to do that. Correct?

Tim: Well, it’s a choice, it’s a choice. The beauty about this program is you can do

things very simply or you can do things more detailed, and it’s up to you to

decide how simple or detailed to do it.

If I was meeting with, say, this guy Mark that we made up and I said, “Hey

Mark, how old are you? How much are you making in your job and about how much

do you have in your 401K?” If you said, “Oh, I got about

750,000,” I’m like, “Oh. Okay, cool. How much are you saving to

that?” I could do that, “How much you have in taxable, Mark?” I

can just quickly enter it right here. That’s the quick and dirty, quick and

simple.

Alan: That’s right.

Tim: Or, and that’s the part that you discovered Alan. Or instead of that, you can click

on “investments,” and then I can get really detailed with each

account.

I can have Mark’s 401K at, I’m just making this up. I know this is a total

hypothetical guy, but then let’s say he left that job and he left his 401K at

GE and then he went to … He has a 401K at, I don’t know, IBM. I’m just making

this up.

Alan: Right.

Tim: Let’s say Mark has a regular IRA.

Alan: A Roth.

Tim: Yeah. Then Mark has a Roth IRA. You can see how you can get it all, it may add up to

the same amount of money we had that we were just putting in as a thumbnail.

Alan: Right.

Tim: Like, we put like 750, so we can make all this add up to 750 right here and put the

returns. Then we could put his wife on here and set it to spouse. Let’s say his

wife’s name’s, Susan, and she has a 401K. Then we’d set owner to spouse, and

we’d make all this qualified. Anyway, this wasn’t meant to be a demo, but when

you bring something up and I can show it really, really quickly, so just give

people a taste.

The investments screen lets you do this stuff in detail. I would say if they have

more than two, three, four accounts … Or you’re going to give them a printout

and you want to make sure on the printout they can see that you looked at each

account, even if it’s only two or three accounts. If they definitely have a

bunch of accounts, you may be better off listing them on here.

Then when you meet with them regularly after they’ve become clients, you can just

update these numbers from each account. You say, “Hey, give me your

statements, and you just go in here, boom, boom, boom, boom. Hit “add to

plan.” Now, I’m going to hit “cancel” because I don’t want to

override the other numbers, but that’s what he’s talking about. Does that make

sense?

Alan: Yes. That’s what I do too. Of course, I’ll do the thumbnail as you described it here

maybe the first time they’re in and just show them where they’re at. Then for

their next appointment, I’ll have everything built out individually, like you

just went there. I’ll have their current situation that they’re in now, and

then I’ll save that particular client in their current situation.

Then I’ll go in and build out a new plan for them, showing money going into maybe an

annuity or wherever we’re taking them. Maybe some life insurance or something

like that in there. Then we’ll go to the cash infusion, showing where that

money has been moved from and into what, and then showing the income as well.

It’s just, it’s beautiful. It is a great program. I just love it. This is software I’ve been

wanting for a long time that I finally found. It’s just, it’s so easy to walk

your clients through this. Being, if you go to the spreadsheet, I can show them

in their new situation that we’ve built out, where they actually have more

income at age 90, 95, 100, whatever we’re building it out too.

We always want to, we do two or three or four different scenarios and look at how

much assets are left over at those different ages. Usually, wherever we’re at

with that, that’s what they’re going to want to do. It’s really nice. It works

out great.

Tim: Cool. Let’s, I didn’t want this to go too long, so let’s kind of move towards

“results,” as I call it. Because a piece of software or anything that

you do in business, whether you want to use it, keep using it, how you evaluate

it is, “What’s the success from it?”

You’ve had the software for two and a half months. How many people have you met with

and used the software on during that time, approximately?

Alan: 25 is what I had added up, Tim. 10 of those were current clients. We were,

basically, looking at their situations and making sure everything was going as

planned. Even have, actually, one of them that we’re fixing to have a new sale

with probably here in a couple of months.

Then, 15 of them are new prospects, and we’ve actually sold five of them. Those five

are probably close to around 750,000. Then I have five more [that are close], where the client we were just discussing is going to be a big one this year. It’s over a million

in assets that we’ll be managing and into annuities.

Then I’ve got another one we’re writing in April that’s going to be about 1.4

million. It’s a really nice case that probably, we’re going to do probably half

and half on that one. 50% into annuities and 50% into managed money.

This gentleman is in his 50s probably. All of his assets were pretty much in his

401K, and now he is going to be switching jobs, and so he’s wanting to get all

this money moved, and become a very good client already on some other cases.

We’ve done some life insurance already.

The software, like I say, it’s probably doubled my closing right already, just in

this short period of time as far as new clients.

Tim: Wow. Just recapping what you said, you met with about 25 people. 10 of them were

current clients, but in meeting with them, you help solidify the relationship

is what I’m hearing.

Alan: That’s correct.

Tim: You even got another sale from one of those clients by reviewing their situation.

Alan: That’s correct.

Tim: Would you say then that the tool is great at solidifying existing client relationships?

Alan: Oh, absolutely, absolutely, yeah. You can go in there … We build a three-ring

binder for each one of our clients with everything that we’ve done with them as

far as … We’ll put their annuity contracts in it, their investments, where

they’re at.

They got all that, and at the same time though, we can go back in there now, each

year when they come in for their annual review, and put everything we’ve done,

because we have copies. We’ll go in and build it into RetirementView, and now

that’s something we’ll have from now and can look at that each year and update

it as we go. I love it for annual reviews as well.

Tim: Great, so annual reviews. Then you met with 15 prospects, and out of those you already

closed five and you’re going to, you think you’re going to close another five.

Alan: Yes.

Tim: That’s 10 out of 15.

Alan: That’s right.

Tim: That’s about a two-thirds closing ratio!You’re saying prior to RetirementView, you

only closed about half that percentage? Somewhere around 30 something percent?

Alan: Yes, yes. Probably 30 to 40% is where we normally are.

Tim: Wow, that’s incredible. All right. I’m kind of putting you on the spot here. Out of

all these 10 people and maybe even the one case from an existing client, how

much is one client worth to you? Or and/or like just estimate at a high level,

like really thumbnail how much those 10 cases or 11 cases are worth to you,

just to give an idea to someone listening. Like they spent a few hundred

dollars on a piece of software, and what was your return in only two and a half

months?

Alan: Well, and to maybe … I have a local radio show here, so I get in some pretty good

clients, as far as that have a significant amount of assets, from the show. I’m

going to tell you, with the one we’re looking at right now, I’m going to say

they’re going to average between 12 to 13,000 per case.

I’m going off the top of my head right now, but I mean, I’ve got the one case I was

just telling you about that’s going to be probably, it’s going to be over, ooh,

probably close to $50,000 in commissions on it alone with the life insurance,

the annuities and the managed money that’s going into it.

Then I’ve got several other cases that … Of the 5 of the 15 we did not sell, we’re

not giving up on them. We’re dripping on them now so they could very well

become clients at some point. Like I say, I guarantee you after a year, I’ll be

able to go in there and tell you what it’s meant to me as far as the raise for

each client that it’s given me.

Because, I mean, when we do that thumbnail sketch in the first interview, Tim, they’re

telling me about more assets than I knew they had, coming in, once they see

that. They want the red to go away, just like I do.

Tim: Did you ever find … Let’s just get into that. I was going to wrap up, but I want

to dig into that because I’ve had other advisors tell me this too, that people

come in and they kind of tell you they have x dollars in a certain account and

when they see that red, all of a sudden they’ve got a bunch more money.

“Oh, Alan, I forgot to tell you about this other account.” Right?

Alan: That’s right … Or the wife, or the wife’s sitting there and saying, “Well, Charlie,

you didn’t tell him about the other account, my 401K,” or it’s just they’ll start

coming up with more assets. I understand that. I think a lot of people just

want to kind of come in, in the beginning really, and see, maybe see what you

know as well.

Tim: They’re cautious, they’re cautious.

Alan: That’s right, that’s right. I don’t blame them a bit. They say, they really open up

once they see RetirementView, it’s incredible.

Tim: They not only open up, they get out of their chair and they want to open up even

more and sit even closer, right?

Alan: That’s right, absolutely. They’re either sitting on the edge of their chair or their moving to one that’s closer. Absolutely.

Tim: Yeah. Well, cool. Well, based on-

Alan: I’m not exaggerating.

Tim: Yeah, that’s awesome. Well, based on the numbers you mentioned, I probably should

have wrapped that up. You said you had maybe 10 cases, the average commission

is probably in the 12, 13 range, and you had one big case you might make about

50 on.

Alan: That’s right.

Tim: It sounds like you’re going to make somewhere around $160K or so in a couple of

months, and that won’t include the assets under management that you continue to

manage over the next few years.

Alan: That’s correct, that’s correct. That’s what I think a lot that will really happen, is

I think it’s really going to help your assets under management. Because it’s

almost automatic, once they see this, that their assets under management are

going to come to you. I’m seeing, grabbing the assets under management is a lot

easier now with this, so it’s exciting.

Tim: Why do you think that is? Why do think that the assets under management are like

magnetically attracted to you… After doing RetirementView?

Alan: Number one, I think they see you … Like I say, I build out different scenarios for

them, and a lot of times I’m not even changing the investment return. Most of

the time I’m very conservative with their investment return, between four and

four and a half percent.

We’re not getting aggressive out there, but it’s just the changes that we make, like

maybe giving them some guaranteed income. If they’ve got enough guaranteed

income from the annuities, then those assets, we’re not taking any principal

from growth, and those assets are multiplying by interest upon interest. That

helps, I think, with them.

Just, we discuss with them our philosophy of having maybe 50% of assets under

management and 50% in income. Understanding, talking about the losses in the

market and, “We don’t want all of our assets at risk, possibly.” I

think that helps, and showing them that picture really helps a lot. Like I say,

it’s really a good picture for them. I think that helps.

Of course, we’ve got a big board on our wall that talks about managing risk. It

shows green, yellow and red money and their percentages that they have in each

one of those categories, so we’ll kind of talk about that, “This is where

you’re at, and this is how it looks on RetirementView.” It helps, it helps

a lot with the managed money. I’m excited as far as what I think it may do with

our managed money over the next five years.

Tim: Yeah, that’s incredible. I mean, you’ve already seen in two months what it’s going to

do. Now you can start to extrapolate what it’s going to do for the next, rest

of 2019. If you can think of that, you start thinking, like you just said,

“What about the next five years?”

That’s what I try to tell people, is like if you can find something that increases

your business by 10, 20, 30, 40% it’s not only going to do it for a month or

two, but a year or two, but 5 or 10 years, now you’ve got a huge impact on your

practice.

Alan: That’s right, that’s right. I agree with you 100%. I think it’s going to make a huge

impact on the practice. Like I say, if you’re looking, if someone out there is

listening and they’re looking for some easy software to navigate through and

get their clients excited, RetirementView is it, man!

Tim: Well, that’s awesome. I really love to hear that. I appreciate you being on here,

sharing your experience, Alan. I’m glad it’s working for you and I wish you so

much success with this.

Alan: Well, thank you Tim. I appreciate all your help that you’ve given me and like I say,

I look forward to getting better at it all the time.

Tim: All right. Well, thanks again for your time. This is Tim Turner and Alan Cantrell.

We’re signing off, and happy planning. We’ll see you. Bye.

Real-World Retirement Planning

What I Should Have Said For Real-World Retirement Planning

The NY Times posted an article recently from Paul B. Brown. He’s a former advisor and author. When asked if he would change the advice he gave he said, ” No, I wouldn’t change any of the advice. I told people to start saving aggressively while they’re young and to diversify their holdings. — But I would have provided not only more empathy, but more real-world advice as well.”

The article goes on to detail 3 examples of things he would say now – in hindsight. He talks about the age of retirement, the reality of life and finances as well as those special expenses that come along. He actually even gives a percentage goal for how much you’ll need – which may surprise you.

You can read the full article here.

Radical New Strategy for Advisors in Asset Planning

Family asset planning

Have you ever considered providing asset planning for the whole family when consulting with your clients?

Forbes October magazine has an interesting article about a pilot program from an advisor with Wells Fargo.

We probably all know of situations in which a family death began a feud over what money and possessions remain. It doesn’t seem to matter if it’s great amounts of money or small. It always has the potential to get unpleasant.

The program highlighted in this article seeks to counsel families in how to plan for the inheritances – before death – so that everyone makes the best use of the assets. Parents are finding comfort through this program in discussing their financial standing openly and honestly with their children so that they can plan to make the best use of their inheritance. It also gives peace of mind to the parents that their gifts will be used appropriately and not be wasted on foolish gains and activities.

The clients noted in the article are, admittedly, dealing with massive amounts of money. Maybe you have some of those clients yourself. Maybe your clients with less money could benefit from a similar approach as well.

Take a look at the article and see what you think. This program is reporting huge success and say they have people beating down the doors to be involved. Could this work for you in your practice?

April 2017 Newsletter

How is it already April? This year just keeps HOPPING along.

March Newsletter 2017

Hear Ye! Hear Ye!

[Old Links Removed] – Hot off the presses! ––[Old Links Removed]

Leprechauns & St. Pat’s Day

March is getting to be “St. Patrick’s Day” MONTH as people celebrate the Irish green. Where did St. Patrick’s Day come from?

March is getting to be “St. Patrick’s Day” MONTH as people celebrate the Irish green. Where did St. Patrick’s Day come from?

According to Wikipedia: Saint Patrick’s Day was made an official Christian feast day in the early 17th century and is observed by the Catholic Church, the Anglican Communion (especially the Church of Ireland), the Eastern Orthodox Church, and the Lutheran Church. The day commemorates Saint Patrick and the arrival of Christianity in Ireland, and celebrates the heritage and culture of the Irish in general. Celebrations generally involve public parades and festivals, cèilidhs, and the wearing of green attire or shamrocks.

I’ve always wondered how Leprechauns have been associated with St. Patrick’s Day and tried to find it online. I found a lot of sites talking about Leprechauns, but none that say why they are associated with St. Patrick’s Day. This is the info that I found courtesy of http://www.holidayinsights.com.

Leprechauns, or little people, are Irish fairies about two feet tall. Leprechauns are dressed in green and are shoemakers. They can be found by following the sound of their hammering. They are believed to have hidden away a pot of gold. If you catch a Leprechaun, they have to lead you to their treasure. But, be wary, if you take their eye off of them they will get away.

Leprechauns are sly creatures, and will try to trick you into looking away so they can escape and not have to give you their treasure. They are also a bit of a loner, and rarely seen in groups. Seldom do you even see pairs of Leprechauns together.

Just curious, do your clients view you as a “Leprechaun” financial advisor? That now that they’ve caught you that you are going to bring them a big pot ‘o gold? My guess is you have to “manage expectations” so that they understand you are not a miracle worker.

I’ve looked at a LOT of retirement pictures and some look great, and others… well the person has just not been diligent enough in their savings. Their expectations of how to live off so little in retirement probably lead them to a “lottery” mentality. That they will win big. Or that they will catch a Leprechaun and get his gold.

I’ve also met a lot of financial advisors that aren’t realistic about why they are not growing their practice. They have very few leads and claim “I get referrals”. They spend virtually no money on “real” marketing – by which I mean systematic efforts that bring real potential clients into their office on a regular basis. Or worse, they try something one time and conclude “it doesn’t work”.

“Real marketing” requires ongoing continuous effort to track, assess, hone, and improve so that over time the marketing is bringing a profitable ROI. It’s not a one-time expense. It’s an ongoing effort. Ideally, a “system” that is put in place and constantly worked.

If your practice is growing and you want to accelerate that growth “faster”, or if you want to put “something” in place that is foundational for generating leads, please contact my assistant Suzie at suzie@torrid-tech.com to set up a time to discuss your practice. If you are broke and constantly chasing shiny new items procured by Leprechauns, please don’t waste my time. Serious inquiries only.

Meanwhile, I think I just saw a Leprechaun running over that yonder hill. I’d better ignore it and get back to some real work!

Tim Turner

Recent Comments