This video will show you an example of how Required Minimum Distributions from a Qualified account can increase the taxation of Social Security enough so that it is thousands of dollars a year.

Taking Advantage of 401(k) Catch-up Contributions

Did you know that you can contribute more money to your 401(k) plan once you reach the age of 50? These catch-up contributions also come with tax savings!

US News posted an article this week that will give you all the details, but to hit the highlights:

For 2021, you can make catch-up contributions to your 401(k) for up to $6500. You can also defer paying income tax on as much as $19, 500. That gives you as much as $26,000 that gets a temporary pass on taxation.

If you’re currently contributing to your 401(k) using a percentage of your income, be sure you adjust the percentage to meet the new minimum once you turn 50.

Want to know more about the tax benefits of this or how to make these catch-up payments, check out the article on USNews.com

RetirementView Support for Cloud Storage and Shared Network Folders

Starting with release 2020.2 we have added new support to make it easier to use cloud storage systems like:

Google Drive

Dropbox

iCloud Drive

OneDrive

Box

IDrive

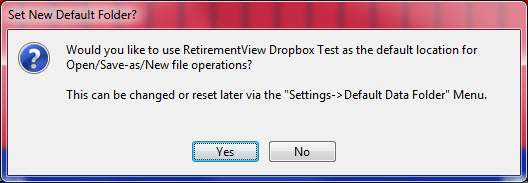

Basically when you create New files, you can move the files to use your cloud storage. When you do that, RetirementView will now ask you if you want to use that location as the “default” for creating, opening, and saving your data files.

If you say “Yes” then every time you create or open a file it will default to your cloud storage location.

The advantage is that it saves a LOT of clicks each time you are working with files.

This same update also helps if you are using a “Shared Folder” on a network in your office. You can go there once and it will ask if you want that as your default. If you say “Yes” then you won’t have to do all those clicks again!

Hope you enjoy this new enhancement…

Thanks and Happy Planning!

Living to Age 110 – Would you run out of Money?

In a recent news article, a Texas grandmother named Elizabeth Francis reached the incredible age of 110 years old!

She credits her faith in God for her long and healthy life. You can read the full article right here.

What if you or your spouse lived to be 110?

Let’s assume you receive Social Security for some basic needs. But that you have to supplement your Social Security with additional income in order to make ends meet in retirement.

We have selected a range of “additional” funds you would need annually.

We have then assumed a 2.5% inflation rate.

We also assume you need this extra money starting at age 65 until age 110.

The table below shows the TOTAL of all those additional funds you would need to meet the inflated annual income goal that you might need.

Some Retirement Calculations to Review

| Annual Amount | Total Amount Over 45 years |

| $25,000 | $2,037,903 |

| $30,000 | $2,445,484 |

| $35,000 | $2,853,065 |

| $40,000 | $3,260,645 |

| $45,000 | $3,668,226 |

| $50,000 | $4,075,807 |

Where are you going to get all those funds?

And how much do you really need?

Well if you download the RetirementView software, you can enter EVERYTHING you can think of that might affect your retirement finances.

Here are a few items it covers (but not an exhaustive list… you can enter way more):

- Your expenses in retirement

- Inflation

- All your Investments (Qualified, Non-Qualified, Taxable and Tax Free)

- Social Security

- Pensions

- Growth and Returns

- Taxes

- Life insurance

- Annuities

- Part-time Job

- Sale of Business

- Downsizing your Home

- Rental Properties

- Severance packages

- Increased medical costs or long term care

RetirementView to the Rescue

When you enter all the info, it takes only about 15-20 minutes.

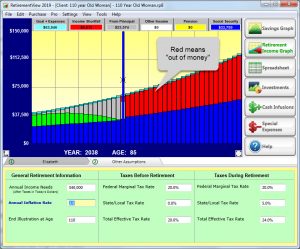

Then VOILA you can see for yourself if you are going to “run out of money”.

Check out this sample screen. The RED means you have run out of money at that age.

Conclusion: You Need to Run Your Own Numbers

Would you like to give this a try and see how YOUR info will play out in retirement?

There is no easier, more accurate, or secure way to run your own numbers than with RetirementView.

Our motto is “Keep It Simple” so it’s not hard to do or “confusing”.

You can start by downloading the Mac or Windows version.

Thanks and HAPPY PLANNING!

Mystery: The Case of the Jumping Social Security Income

Hello,

Glad you are here and I wanted to try to make this article a little LESS BORING by telling the story of a MYSTERY that needs to be solved.

Do you have a bit of Sherlock Holmes in you? Can you crack this case?

The taxation of Social Security is a bit of a complicated topic, but the basics are that the IRS has a specific worksheet that you can fill out to figure out the “tax” you will owe on your Social Security. Part of your Social Security is tax free, but then it can jump up to 50% or 85% taxable depending on other income and various factors.

If you want to learn how to calculate it, then consider getting the “Social Security Taxation Kit” that we offer which explains it all through video and worksheets.

Meanwhile, I wanted to share a SPECIFIC case study that an advisor sent in that shows an interesting “visual” anomaly in the RetirementView program. NOTE: this not a the real file but a copy and all identifying information has been removed.

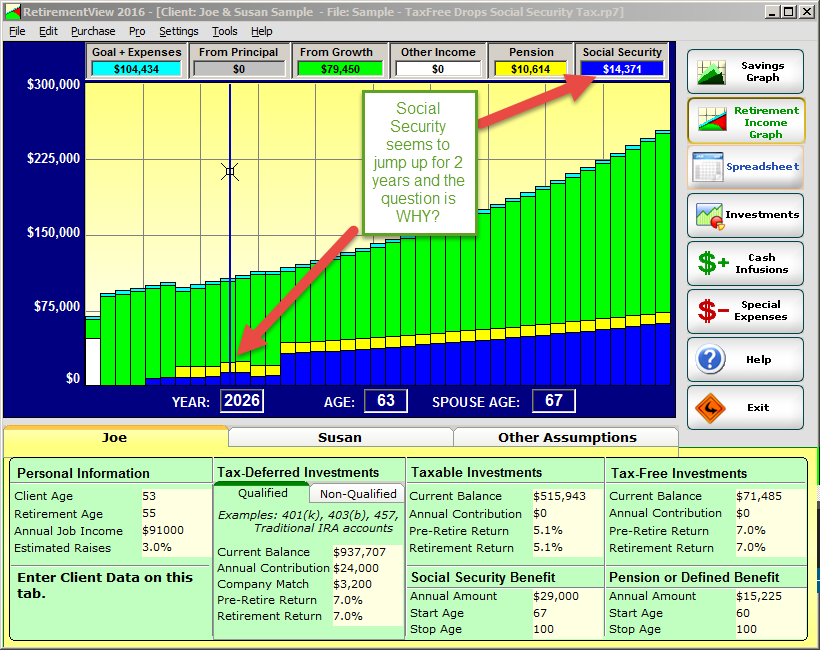

So let’s dig in… first look at the main Retirement Income Graph below. The advisor sent this file in asking “Why does the Social Security jump up by over $4,000 for 2 years and then drop back down? ” You can see where we point out this anomaly in the following graphic:

If you are an advanced RetirementView user, think to yourself “Why would this happen?”

If you are an advanced RetirementView user, think to yourself “Why would this happen?”

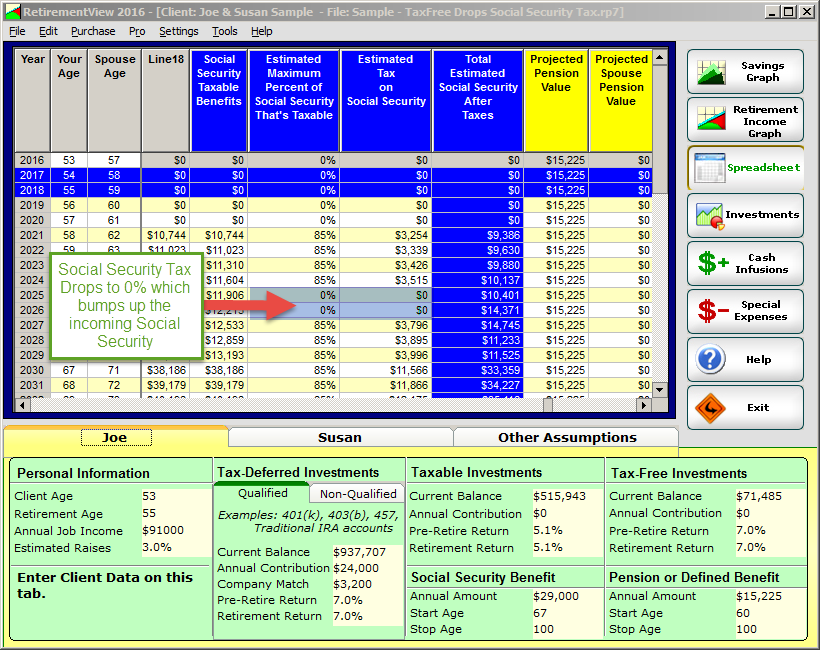

To search for clues about this, I flipped to the Spreadsheet to examine the numbers. If you scroll to the right you will eventually get to the royal blue Social Security columns. Indeed, we see that there are 2 years where the taxation drops from 85% to 0%. This causes the amount of income from Social Security to INCREASE. Notice that’s counterintuitive to think about… taxation DROPS but income INCREASES. I guess that’s why everyone would like lower taxes (except maybe our government).

Here is a graphic showing the spreadsheet columns that are relevant. Now this is an internal copy where we have columns for every one of the Social Security taxation lines on the IRS worksheet so we can validate our calculations.

The question is WHY is this happening. Well first you have to understand the Social Security taxation algorithm which is too much to explain here. But the revelant key is that Tax Free investment withdrawals from a Roth IRA account, do not get added into the calculation of taxes on Social Security. So when you withdraw money from your Roth IRA in retirement, it won’t affect your Social Security taxes at all.

Whereas, when you withdraw from Taxable accounts or Tax-Deferred Accounts like Traditional IRAs and 401(K) plans, then that income IS included in the taxation algorithm for Social Security.

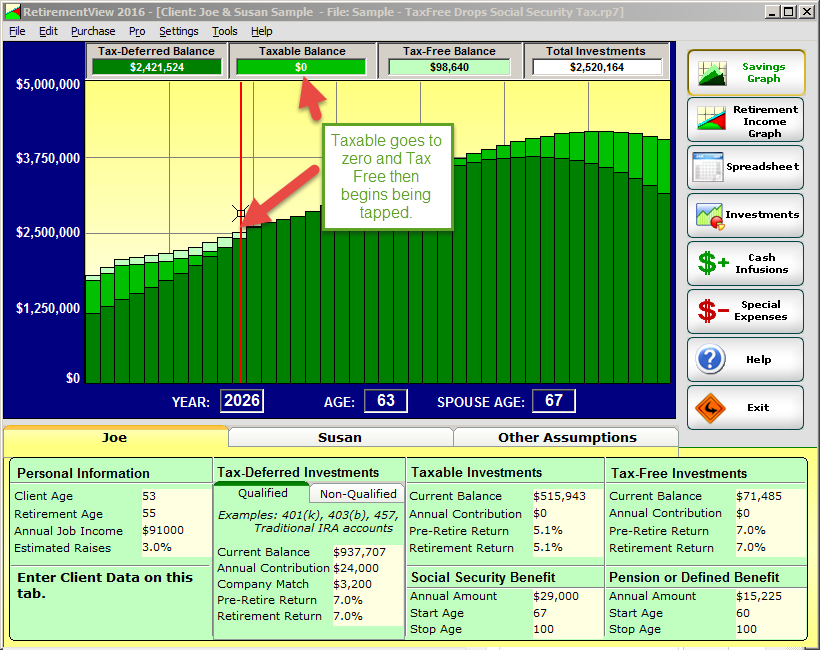

The second clue you need to figure this out is to look at the Savings Graph. When we looked there we see that Taxable investments get depleted right before the anomaly. At that point the program begins to tap the Tax Free investment bucket to satisfy the target retirement income needs. When that happens, the taxation on Social Security drops to 0% and thus the income from Social Security increases by over $4,000!

Here is a screenshot of the Savings Graph pointing out the depletion of Taxable:

Now go back up and see the original Retirement Income Graph picture… you can see the Social Security jump up for two years.

In Retirement View the order of investment depletion is Taxable, Tax Free, Non-Qualified, then last is Qualified. So program taps the Taxable until it is gone and then switches to Tax Free. When it does so, the withdrawals reduce the taxes on Social Security which then increases the net Social Security income after taxes.

And now mystery solved! You know why this is happening.

Another retirement planning case closed. Til next time and Happy Planning!

Regards,

-Tim

Eating Bacon will help you reach Age 116?

Susannah Mushatt Jones just turned 116 and is now the world’s oldest woman!

At age 116, she says that she eats a steady diet of bacon, eggs and grits for breakfast. A sign in her kitchen reads: “Bacon makes everything better.”

She was born in 1899!

If you or your spouse live to be 116, will you be able to afford it? Or will you be stuck on a “fixed income”?

Consider running some numbers using the RetirementView program. You can download a free demo version from our website at: http://www.torrid-tech.com

Read the full article about Susannah at this location:

Consumers Chasing Fool’s Gold

We’ve all heard a thousand times the old tale about finding a pot of gold at the end of a rainbow. We all know it’s just supposed to be a humorous and interesting “old wives tale”. But I find that many people are constantly chasing after “Leprechaun gold”.

Get rich quick schemes are everywhere! The internet is full of them. A quick Google search will lead you to more than you could possibly imagine…some legitimate but many not.

How many of you have been approached to invest $100 in your own business and with just a few hours a week you can become a millionaire? Again, some of these businesses are can help you achieve some extra income, some not but most don’t make the returns in their promises.

You can probably name a few more that you’ve come across in your experience, but nothing can quite meet the good ol’ spend less, save more. If you have the luxury of starting early in life, making wise investments and putting a little away where you can, you will wake up one day and find that your little coins have accumulated into quite a pot of gold.

How can Torrid Technologies help you reach your retirement goals?

We hope that through this newsletter each month, you will find good tips and tricks for saving and investing.

Using our RetirementView Software can help you by looking for the GREEN on your graph. You can play with different scenarios in your plan and see what pays off in your personal plan.

Please let us know how we can assist you or make our product better any time! We don’t want you to leave your retirement security to the “Luck of the Irish”!

Tim Turner Torrid CEO and Founder

Finding Solutions to Key Challenges of Modern Retirement

In the new book, Falling Short: The Coming Retirement Crisis and What to Do About It, Charles Ellis says that while just 30 years ago, most American workers were able to stop working in their early 60’s and enjoy a long and comfortable retirement, that brief golden age is over!

As responsibility for retirement savings shifts from employer to employee, increasing life expectancy and health care costs are key challenges that retirees today will face. On top of that, Social Security is replacing less of pre-retirement income, traditional pension plans are being exchanged for 401k plans with modest balances and employers are not providing health benefits for their retirees.

Mr. Ellis suggests a couple of changes that need to take place. For one, waiting to retire from age 62 until age 70 provides a 76% increase. He ventures that many of his colleagues in the investing world do not know that. He also points out that if your full retirement age is 66, that collecting benefits at the earliest age of 62 results in a 25% reduction in benefits.

Read much more detail about his research at http://tinyurl.com/qbet8dh.

Recent Comments