In a recent news article, a Texas grandmother named Elizabeth Francis reached the incredible age of 110 years old!

She credits her faith in God for her long and healthy life. You can read the full article right here.

What if you or your spouse lived to be 110?

Let’s assume you receive Social Security for some basic needs. But that you have to supplement your Social Security with additional income in order to make ends meet in retirement.

We have selected a range of “additional” funds you would need annually.

We have then assumed a 2.5% inflation rate.

We also assume you need this extra money starting at age 65 until age 110.

The table below shows the TOTAL of all those additional funds you would need to meet the inflated annual income goal that you might need.

Some Retirement Calculations to Review

| Annual Amount | Total Amount Over 45 years |

| $25,000 | $2,037,903 |

| $30,000 | $2,445,484 |

| $35,000 | $2,853,065 |

| $40,000 | $3,260,645 |

| $45,000 | $3,668,226 |

| $50,000 | $4,075,807 |

Where are you going to get all those funds?

And how much do you really need?

Well if you download the RetirementView software, you can enter EVERYTHING you can think of that might affect your retirement finances.

Here are a few items it covers (but not an exhaustive list… you can enter way more):

- Your expenses in retirement

- Inflation

- All your Investments (Qualified, Non-Qualified, Taxable and Tax Free)

- Social Security

- Pensions

- Growth and Returns

- Taxes

- Life insurance

- Annuities

- Part-time Job

- Sale of Business

- Downsizing your Home

- Rental Properties

- Severance packages

- Increased medical costs or long term care

RetirementView to the Rescue

When you enter all the info, it takes only about 15-20 minutes.

Then VOILA you can see for yourself if you are going to “run out of money”.

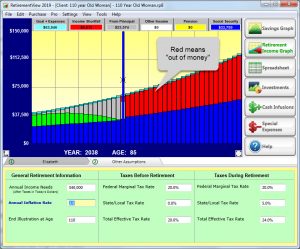

Check out this sample screen. The RED means you have run out of money at that age.

Conclusion: You Need to Run Your Own Numbers

Would you like to give this a try and see how YOUR info will play out in retirement?

There is no easier, more accurate, or secure way to run your own numbers than with RetirementView.

Our motto is “Keep It Simple” so it’s not hard to do or “confusing”.

You can start by downloading the Mac or Windows version.

Thanks and HAPPY PLANNING!

Speak Your Mind

You must be logged in to post a comment.